UK Form C3 2004-2026 free printable template

Show details

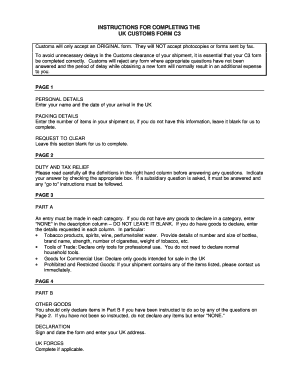

C3 Bringing your personal belongings to the United Kingdom from outside the European Community This form is for you to declare your belongings to Customs and to claim any duty and tax free reliefs that may apply when you return to or transfer your normal home to the EC or when you are a student coming to study in the EC. The reliefs are explained in Customs Notice 3 - Bringing your belongings and private motor vehicle into the United Kingdom from outside the European Community. If you are a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign uk customs declaration form pdf

Edit your c3 bringing your personal belongings if you are a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uk customs c3 form 1999 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

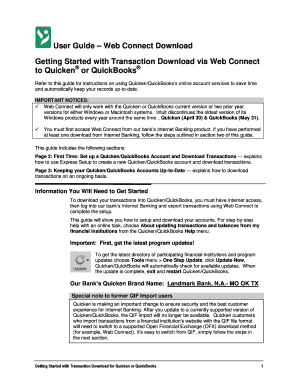

Editing form c3 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 1999 form c3 kingdom fill. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Form C3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out uk customs form

How to fill out UK Form C3

01

Obtain UK Form C3 from the official government website or your local court.

02

Read the instructions carefully before starting to fill out the form.

03

Fill in your personal details, including your name, address, and contact information at the top of the form.

04

Provide details of the case number and court where the proceedings are taking place.

05

Answer all relevant questions in the form honestly and accurately, ensuring you follow the guidance notes.

06

If applicable, include any additional documents or evidence that support your application.

07

Review the completed form to ensure that all sections are filled out correctly and legibly.

08

Sign and date the form at the designated area before submission.

09

Submit the form to the appropriate court or office, making sure to keep a copy for your records.

Who needs UK Form C3?

01

UK Form C3 is required by individuals who are making an application regarding the child arrangements in court.

02

It is needed by parents or guardians seeking to vary or enforce existing child arrangement orders.

03

Legal representatives may also need this form when representing a client in child-related legal matters.

Fill

uk customs declaration form

: Try Risk Free

People Also Ask about uk cash declaration form

What forms do I need for customs?

Each individual arriving into the United States must complete the CBP Declaration Form 6059B. Explanations and a sample declaration form can be found on the Sample Customs Declaration Form.

What documents do I need for UK customs?

Your identity document (for example your passport or identity card) will be checked when you arrive at a UK port or airport to make sure you're allowed to come into the country. It should be valid for the whole of your stay. You may also need a visa to come into or travel through the UK, depending on your nationality.

Do you have to fill out a customs form for UK?

Why do I need to fill out a customs form? Customs forms are now mandatory if you were sending gifts or goods outside of the UK, except if posting to the EU from Northern Ireland. They allow local customs authorities to make sure the goods are permitted and to calculate if there are any duties or taxes to be paid.

Can I print out a customs form online?

Filling Out Customs Forms Online You can print just a customs form or use Click-N-Ship® service to pay for postage and print an international shipping label and a customs form.

Can I complete customs forms online?

You have two main ways to fill out a customs form that can be used for mailing your item: 1 Customs Forms Online: Forms can be electronically generated and printed based on information entered in the application. Simply enter customs information and print customs forms that are appropriate for your mailpiece.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in c3 application form?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your c3 bringing your personal belongings coming to study in the to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in 1999 form c3 bringing fill without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your uk customs declaration, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit c3 forms on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute personal belongings form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is UK Form C3?

UK Form C3 is a form used to apply for a grant of probate or letters of administration in England and Wales. It is typically used when someone has died and their estate needs to be managed and distributed.

Who is required to file UK Form C3?

UK Form C3 is required to be filed by executors or administrators of a deceased person's estate who are seeking to obtain legal authority to deal with the estate.

How to fill out UK Form C3?

To fill out UK Form C3, applicants need to provide details about the deceased, including their full name, date of birth, date of death, address, and details of the estate including assets and liabilities. The form must be completed accurately and submitted to the probate registry.

What is the purpose of UK Form C3?

The purpose of UK Form C3 is to provide a formal application for obtaining a grant of probate or letters of administration, which gives the executor or administrator the legal right to manage the deceased's estate.

What information must be reported on UK Form C3?

The information required on UK Form C3 includes the deceased's personal details, details of their assets and liabilities, the names of beneficiaries, and any other relevant information that helps in assessing the estate.

Fill out your UK Form C3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Microsoft Site Pdffiller Com Site Blog Pdffiller Com is not the form you're looking for?Search for another form here.

Keywords relevant to what is form c3

Related to 1999 form c3 kingdom printable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.